The figures I am using are all from the wikipedia Peak Oil page, just a disclaimer

Peak Oil is an idea first developed by one of this century's great geologists, M. King Hubbert. He introduced his theory in the late 1950's as a way of predicting future oil supplies. The idea is fairly simple, and is based on the fact that oil is a non-renewable resource, and there is consequently a finite supply of oil in the world. Oil production will follow a bell shaped curve. As the demand for oil increases, oil companies increase their supply as much as they can; pumping fields at full capacity and discovering new reserves. Demand continues to increase, but fields begin to dry up, and new fields just don't exist, so production declines. Whatever the exact shape of the curve, the logic is pretty plain, the integrated area under the curve is equal to the total amount of recoverable petroleum reserves in the world. This is Peak Oil, the idea that there will (or has been) a peak in oil production, and that at some point production will decrease, about as rapidly as it initially increased. This model works very well for individual oil fields, or even national reserves

As the demand for oil increases, oil companies increase their supply as much as they can; pumping fields at full capacity and discovering new reserves. Demand continues to increase, but fields begin to dry up, and new fields just don't exist, so production declines. Whatever the exact shape of the curve, the logic is pretty plain, the integrated area under the curve is equal to the total amount of recoverable petroleum reserves in the world. This is Peak Oil, the idea that there will (or has been) a peak in oil production, and that at some point production will decrease, about as rapidly as it initially increased. This model works very well for individual oil fields, or even national reserves

The red curve shows US oil production versus time, with a peak in 1970, and a slight secondary bump thanks to the north slope of Alaska. World oil is in blue.

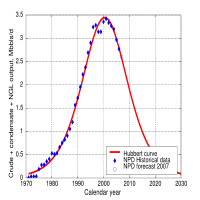

This is the theoretical production curve (red) and actual data for Norwegian production. I don't want to argue the specifics of the model; whether or not the curves are symmetric, how much technology can help (answer jack squat), when the peak is, etc.. There are some truths that you just can't get around, namely that the amount of oil in the world is finite. and that at some point we will be using more than we can extract, and production rates will decline.

Arguments against peak oil seem to follow the lines of "the market solves everything." As supply decreases, price increases, and demand decreases, thank god for the market, it will save us all. Oil will get expensive, and some budding entrepreneur will devise some amazing technology that will save the world! At some level I suppose that is true; if there are humans around in 500 years, they will undoubtedly not be using oil as their primary energy source (they will of course be using flux capacitors). Whether or not it happens isn't the problem, but instead what happens during the transition. Dismissing peak oil with some dreamy ode to market forces ignores how nasty things can get in the face of scarce resources. Technology will find alternatives, but when? Do we decide now to solve the problem before it gets too hairy, or do we wait until something resembling this happens? Hell, remember when stores would run out of Beanie Babies and all hell would break lose? I think oil might be worse.

This brings me to biophysical economics. The term, as used by Charlie Hall, refers to an economic theory that does not violate the laws of nature, especially trivial little ideas like thermodynamics. This is of course a major problem with simple supply and demand, it assumes that supply is only limited by something like factory output. For example, no matter how much the price of oil increases, the supply cannot, and any reasonable replacement would take much longer to develop than the oil would last. Economic theory rooted in physical realities, I like it.

I am less an economist than I am a petroleum geologist (not much), so this post is really not in my wheelhouse. This has sparked my interest though. Are there any more econ-minded folks out there who know about biophysical economics, or any economic theory that explicity takes into account the laws of nature? Any notable economists who consider the natural world, or economics programs that require some line of study like this?

12 comments:

I think the key is the word, "recoverable" For example, you get oil sands and tar shales- things technologically "uneconomic" ages ago, which suddenly come on line as the price increases.

I mean, the total mass of all oil molecules on earth probably exceeds the ammount in reserves by several ordes of magnitude. It is just that the extraction efficiency goes way down.

I don't know a huge amount about petroleum, but aluminium illustrates this. We could extract aluminium from feldspar if we really wanted to- and feldspar is about hald of teh earth's crust. It's just that it would be really expensive and energy intensive.

The figure I like best, which is a few screenfulls down on the energy bulletin, is the one that charts global annual oil discovery and production on the same time axis. Somewhere, you can find similar graphs for US discovery and production. Ultimately, the integral of the production curve has to be less than or equal to the discovery curve.

What I would like to ask the folks who think that market forces will always create technology to solve problems is: "why hasn't the market invented a cure for the common cold?"

Market forces might work for solutions if the costs were actually included in what consumers have to pay. This always kills me, lets remove all of the oil subsudies, let's add in taxes to compensate for dealing with the all of the problems they cause....but even if I was a market groupie (I am sure we all know some), artificial price suppression doesn't seem to fit in the equation.

Lemming - I agree, recoverable is the key. Will things like oil shales really ever make energy sense? The difference the last 20 years of technology has made in the amount that can be recovered isn't terribly large (what I have understood second hand), perhaps it is time to unveil my super secret oil magnet...

TC, it depends on the price.

At $200 / barrel, oil shales are plenty profitable.

Even at $50, I think the canadians are using some of theirs, which is one reason they are going to miss their Kyoto target.

While it doesn't seem technology or market forces can make much of a difference, they actually DO, which is what may cause some of the problems around determining peak oil. BP has some fairly sound data available on their site, and one thing you can check is the reserves to production ratio. In other words, if you produce at current capacity, how long before the reserves run out. North American oil pretty much peaked in the 1970s, but the reserves/production ratio has flatlined at 10-20 years since then. For the last 30 years we've had an expected 10-20 years of oil left. Clearly technology, efficiency, exploration, etc. is the reason behind this flatline, and the investments behind those improvements are driven by the market. When you're losing 5% of output due to inefficiency, you fix it. Conservation, wherever it can be found, is always going to be an energy source in this energy thirsty world. Not that the market can solve everything, but it can make a big difference in a sloppy industry. IMHO. Note - not that this gets into the Saudi reserve question, a la Simmons' "Twilight in the Desert"; that just gives me a headache.

I guess when I think cost I think energy cost, not so much monetary cost, when do we reach the point where we put in as much as wwe get out (the problem we seem to be having with corn derived ethanol)?

You have to remember too that at one time methane was seen as a nuisance by-product of oil production to be expelled or burned off. Part of the energy boom is that methane is now seen as an economically viable energy source. So oil shale is one end of the "is it economical/feasible?" spectrum, the other is methane, of which a steady supply from bovine waste lies untapped every day. Or from coalbed methane. Or frozen methanye hydrates on the sea floor. Theres lots of hydrocarbons out there but harnessing it and how is the technology that may make the oil well production curve less predictive than it may seem, not whether or not we can sqeeze more out of the Permian basin.

The problem is transportation. We can find replacement energy for a lot of our energy needs, but not transportation. One missed turn signal with a liquified natural gas tank = kaboom! If we figure out another transportation fuel, we should be good in our current standard of living for another 1000 years, til cold fusion comes online or the end-Holocene extinction from catastrophic increase in CO2, which ever happens first. But that's another topic altogether.

Actually, here in Australia cars have been running on LPG for over a decade now- virtually all the taxis, and many private cars as well, and there has been no upsurge in catastrophic explosions. Aside from air travel, most everything else could be converted to a gas fuel.

i'm getting to the discussion late...it may have sizzled.

I would also add in the recoverable reserves aspect regarding 'conventional' hydrocarbons as well (i.e., not tar sands, oil shale, hydrates, etc.). A typical conventional oil field recovers 30% of the oil that's in the ground (this varies quite a bit of course). After that it can be uneconomic to use secondary or tertiary recovery methods to squeeze more out of the ground. Both the economics and the technology of bringing that 30% up to, say 70% will also extend 'peak' oil.

That being said...i would emphasize the word extend...as you point out, it is finite at some point.

And as for Simmons estimates of the Saudis gross overreporting of reserves....that could be the biggest wild card of them all.

Finally...I would agree that relying on magical market forces to fix everything is dangerous...but I also wouldn't discount them as being significant.

Just found this post while looking up "biophysical economics"...and if you want to research it, Complexity Economics (my economic school of thought) is based on the emergent properties of evolutionary models.

"The Origin of Wealth", by Eric Beinhocker is a great book to read on the subject =].

Good luck!

Just found this post while looking up "biophysical economics"...and if you want to research it, Complexity Economics (my economic school of thought) is based on the emergent properties of evolutionary models.

"The Origin of Wealth", by Eric Beinhocker is a great book to read on the subject =].

Good luck!

Post a Comment